As we navigate the landscape of Extended Producer Responsibility (EPR) and PRNs in 2024, it's crucial to maintain a steady perspective amidst regulatory updates and shifting market dynamics.

Read More

Blog

Keep on top of the waste management industry.

- All

- Ask the Experts

- Business Advice

- Collection Services

- Confidential waste

- Electrical Waste

- Energy

- Event Waste Management

- Flame UK

- Food Waste

- Hazardous Waste

- Holidays

- Litter Picking

- Meet The Team

- Packaging Waste Regulations

- Pallets

- Plastic Tax

- Recycling

- Tankering

- Uncategorised

- Waste

- Waste Balers and Equipment

- Water

Waste Disposal Costs – What Should We Expect in 2024?

February 8, 2024

February 8, 2024

The anticipated increase in waste disposal costs is approaching. As we embark on this exploration, it's crucial to understand the multifaceted factors driving this upward trend.

Read More

Dreaming of a Green Christmas: Offsetting Carbon for the Festive Period

December 7, 2023

December 7, 2023

To combat the carbon footprint associated with these festive travels, we have pledged to offset the average travel of 700 miles for each of our employees.

Read More

AI in the Waste and Environmental Industry: Unveiling Trends for 2024 and Beyond

November 27, 2023

November 27, 2023

Discover how AI-driven technologies, from smart bins to intelligent transfer stations, are reshaping waste management and changing the waste industry.

Read More

Your Guide to Overcoming Facilities Management Challenges: What they are and how to resolve them

November 8, 2023

November 8, 2023

Learn how to overcome common facilities management challenges, including aligning infrastructure, cost control, compliance, sustainability, space optimization, and technology integration. Get practical solutions and expert advice from Flame UK to make your facility more efficient, compliant, and sustainable while keeping costs under control.

Read More

From 06 April 2024, All Workplaces in Wales Must Separate Their Waste for Recycling

October 24, 2023

October 24, 2023

Starting from April 6, 2024, a significant change is set to take place in workplaces across Wales. The Welsh Government is rolling out new regulations that mandate all businesses to segregate recyclable materials from their general waste.

Read More

Overcoming Sustainability Challenges for SMEs: Expert Insights

October 13, 2023

October 13, 2023

Discover how Small and Medium-sized Enterprises (SMEs) can overcome unique sustainability challenges. Learn from Dan Pegram, Director of Flame UK, as he discusses the evolving landscape of sustainability in the business world and shares expert insights. Find solutions to limited resources, expertise gaps, and building awareness. Sustainability is no longer an option; it's a necessity for modern businesses.

Read More

Understanding Carbon Offsetting: What you need to know

September 22, 2023

September 22, 2023

Carbon offsetting can help your business to eliminate the leftover carbon emissions your business can't reduce from its operations.

Read More

Aerosol Recycling: Is your business safe?

September 13, 2023

September 13, 2023

What happens if aerosols aren’t recycled correctly? Here’s everything your business needs to know about recycling used aerosol cans.

Read More

Washroom Services for Construction Sites

September 6, 2023

September 6, 2023

Washroom services for constructions sites are a key factor in staying compliant and keeping staff happy. But what exactly do you need?

Read More

How can you create sustainable festivals?

August 30, 2023

August 30, 2023

Each year, pictures and videos of discarded tents flood social media with calls for more sustainable festivals. But what’s the solution?

Read More

EPR Regulations: Household vs Non-Household Waste

August 29, 2023

August 29, 2023

Under the new EPR regulations, producers will need to pay for the collection and treatment of household waste. But what does it include?

Read More

How you dispose of wood waste is changing

August 25, 2023

August 25, 2023

How construction and demolition sites dispose of wood waste is changing from September 2023. What does this mean for the industry?

Read More

What EPR fees should my business expect?

August 21, 2023

August 21, 2023

With EPR, organisations need to be prepared for an overhaul in the PRN system. But what EPR fees should your business expect?

Read More

Did you know you can change your PRN compliance scheme?

August 15, 2023

August 15, 2023

Navigating EPR can be tricky. This is where a good PRN compliance scheme comes in. But did you know you can change your scheme?

Read More

Hole in One: Flame UK raises over a grand for Age UK!

August 11, 2023

August 11, 2023

Two members of Flame UK raised over a grand for Age UK by completing the 72-Hole Golf Challenge!

Read More

Defra launch consultation on the draft EPR regulations

August 7, 2023

August 7, 2023

Defra launch a consultation on the draft EPR regulations to receive industry views on the new draft regulations.

Read More

Ask the Experts: Joe – Managing Multi-Site Waste

August 2, 2023

August 2, 2023

We sat down with Joe to learn more about managing multi-site waste.

Read More

Defra confirm delay to Extended Producer Responsibility EPR Fees

July 26, 2023

July 26, 2023

Defra confirms a delay to Extended Producer Responsibility (EPR) waste management fees until 2025 in the hopes of driving down inflation.

Read More

Why should your business become ISO 14001 certified?

July 24, 2023

July 24, 2023

Looking to become ISO 14001 certified to show your business' commitment to sustainability? Here's the benefits of the certification.

Read More

What is a PRN? Packaging waste regulations

July 18, 2023

July 18, 2023

It’s getting around to that time of year again, looking back on the last calendar year, calculating your data, talking to your suppliers and delving deep into every product you buy, use and sell!

Read More

What is Zero to Landfill and how can it be the key driver of your business’ performance?

July 14, 2023

July 14, 2023

The term 'zero to landfill' is thrown around a lot in the waste industry. But what does it mean and why should you consider it?

Read More

Plastic Free July: Plastics and the Environment

July 10, 2023

July 10, 2023

This July, we’re taking a deeper look at the damaging effects single-use plastic can have on the environment and what businesses can do to combat this. Plastic Free July, a global movement to reduce plastic pollution, highlights the changes people and businesses can make to cut the amount of single-use plastic they use.

Read More

Net Zero Week 2023: What role does waste play?

July 5, 2023

July 5, 2023

This Net Zero Week, we're looking at the role waste plays in becoming Net Zero and what your business can do to reduce emissions.

Read More

Flame UK Highly Commended at Midlands Family Business Awards

July 3, 2023

July 3, 2023

Flame UK are extremely pleased to be Highly Commended for two awards at the Midlands Family Business Awards.

Read More

Ask the Experts: Lydia – Site Clearances

June 28, 2023

June 28, 2023

We sat down with Lydia, one of our waste experts, to find out everything you need to know about site clearances.

Read More

Single-Use Plastics Ban: What businesses need to know

June 26, 2023

June 26, 2023

Back in January 2023, the government announced they would be banning the sale of single-use plastics in England. But what does this mean for your business?

Read More

Manufacturing Waste: How to become more sustainable

June 23, 2023

June 23, 2023

What can you do to improve your manufacturing waste management and become more sustainable? Here's our four top tips!

Read More

Have you thought about bin cleaning?

June 20, 2023

June 20, 2023

The cleanliness of your bin might be at the bottom of your priority list. But regularly bin cleaning can be beneficial for your site.

Read More

Why you should be using a waste management broker

June 13, 2023

June 13, 2023

Using a waste management broker for your business’ waste simplifies the process, letting you get back to business.

Read More

Winter event waste: Start planning now

June 8, 2023

June 8, 2023

It's never too soon to start planning your winter event waste management. Here's our guide for everything you'll need to cover.

Read More

We’re finalists at the Midlands Family Business Awards!

June 5, 2023

June 5, 2023

Flame UK are pleased to announce that we’ve been selected as finalists at the Midlands Family Business Awards 2023.

Read More

PRN Market Update: May 2023

May 30, 2023

May 30, 2023

With PRN prices always changing, it's hard to keep up to date. But what can we learn about the PRN market from the first quarter of 2023?

Read More

How to dispose of healthcare waste

May 22, 2023

May 22, 2023

Healthcare organisations generate multiple waste streams. Learn how to dispose of healthcare waste in a safe and environmentally friendly way.

Read More

Festival Litter Picking: Keeping your event clean

May 16, 2023

May 16, 2023

It's nearly the time of year for different festivals. But why is festival litter picking so important for your event's waste management?

Read More

Battery Recycling: What you need to know

May 10, 2023

May 10, 2023

Every business will have batteries lying around. Here’s Flame UK’s guide to battery recycling to ensure they're disposed of correctly.

Read More

Retail Waste Management: Streamlining the process

May 3, 2023

May 3, 2023

When you’re running a busy shop, retail waste management is the last thing on your mind. But, if not done right, it could be costly.

Read More

Ask the Experts: Jake – Dealing with Asbestos

April 28, 2023

April 28, 2023

We sat down with one of our waste experts, Jake, to find out how you can stay safe if you find asbestos on your business' site.

Read More

Large Scale Refurbishment: How to manage your waste

April 24, 2023

April 24, 2023

Is your site planning for a refurbishment? Here’s our tips for managing waste during large scale refurbishment.

Read More

Earth Day 2023: How can your business become more sustainable

April 21, 2023

April 21, 2023

This year’s Earth Day focuses on ‘Invest in our Planet’, encouraging people to focus more on the environmental impact they have to build a better future. It’s more important than ever that businesses focus on becoming more sustainable to protect the planet.

Read More

SmartTrash Waste Monitoring: The Ultimate Guide

April 19, 2023

April 19, 2023

Does your business have a compactor? If you’re not using SmartTrash, you could be paying for waste collections that you don’t need.

Read More

How to dispose of your waste cooking oil

April 14, 2023

April 14, 2023

If you’ve worked in a busy restaurant, you’ll know that waste cooking oil is a common sight. It’s important that you’re storing and disposing of it to protect the environment and stay compliant with legislation. But what should you do with your waste oil once it’s cooked a batch of chips?

Read More

Can waste collections ever be carbon neutral?

April 11, 2023

April 11, 2023

While we work hard to find the greenest options for your waste, it can be disheartening to hear about the amount of CO2 produced. But there is a greener future in store for waste collections and they can become carbon neutral. Here’s how:

Read More

Managing construction waste more efficiently

April 4, 2023

April 4, 2023

Managing waste on your construction site can be a bit tricky. With all the different waste streams generated on these sites, there’s a lot you’ll need to have covered. Here’s Flame UK’s guide to managing your construction waste more efficiently to keep all your site’s waste streams covered.

Read More

How Extended Producer Responsibility changes PRNs

April 4, 2023

April 4, 2023

The switch to the Extended Producer Responsibility will cause a shake up, with the eligibility criteria for purchasing PRNs changing.

Read More

Ask the Experts: Ross – Chemical Waste

March 31, 2023

March 31, 2023

We sat down with one of our waste experts, Ross, to find out the best ways to manage your business' chemical waste more effectively.

Read More

ISO 14001: 5 ways to support your environmental goals

March 27, 2023

March 27, 2023

There are over 300,000 businesses across 171 countries that are ISO 14001 certified. Here’s five things you can do to join them.

Read More

Flame UK are Cyber Essentials Plus Accredited

March 22, 2023

March 22, 2023

In a move to provide extra security for our customers, Flame UK has become Cyber Essentials accredited.

Read More

POPs: What you need to know

March 20, 2023

March 20, 2023

If the waste you’re producing contains POPs, it needs to be treated differently to ensure everyone’s safety. Here's Flame UK's guide to POPs.

Read More

Landfill Tax: What you need to know

March 16, 2023

March 16, 2023

First introduced in 1996, landfill tax is an environmental tax placed on all waste sent to landfill. Each year, on 1st April, the tax increases. But what is it, what’s its purpose and what’s the increase for 2023?

Read More

What is clinical waste and how to dispose of it?

March 13, 2023

March 13, 2023

Clinical waste needs to be handled and disposed of correctly to make sure that everyone who comes into contact with it is safe. But what is classed as clinical waste and how can you ensure it’s stored and disposed of correctly?

Read More

Environmentally Friendly Waste Collections: Our Tips

March 9, 2023

March 9, 2023

Here’s our top tips for making your waste collections are as environmentally friendly as possible.

Read More

Food Waste Action Week: Top tips for cutting food waste

March 6, 2023

March 6, 2023

This week marks the third annual Food Waste Action Week organised by WRAP. This year’s campaign focuses on ‘Win. Don’t Bin’, encouraging people to use up their leftovers to reduce the amount of food waste they’re producing and save money, time and the planet. Here’s Flame UK’s top five tips for reducing the amount of food waste you produce.

Read More

Why are waste costs rising?

March 3, 2023

March 3, 2023

The previous financial year has been a tough time for a lot of businesses. As the cost of living crisis continues, businesses are having to adapt to a new landscape with much higher costs. But why is this happening and how can your business keep its waste costs as low as possible?

Read More

British Standard for Confidential Waste: What is BS EN 15173?

February 28, 2023

February 28, 2023

All businesses have a legal requirement to ensure that any confidential information they have is correctly disposed of. This covers anything from details you may have about your customers, employees and even suppliers. If you fail to comply with this legislation, you could be leaving your business liable to hefty fines or even imprisonment.

Read More

Waste Reporting: What happens to my waste?

February 24, 2023

February 24, 2023

It can be quite easy to overlook and forget what happens to our waste when we throw it away, but the process of what happens to the waste may be more interesting than you realise. When disposed of correctly, we can keep you up with what happens to your waste for that extra peace of mind.

Read More

Ask the Experts: George – Cardboard Collection

February 20, 2023

February 20, 2023

We sat down with George, one of our waste experts, to find out the best tips and tricks for managing your cardboard waste.

Read More

Waste in the leisure industry

February 16, 2023

February 16, 2023

Waste in the leisure industry is inevitable. Here’s our guide to everything you’ll need to keep all your waste streams covered.

Read More

Can you recycle disposable vapes?

February 13, 2023

February 13, 2023

Around two disposable vapes are thrown away every second. Here's how you can recycle your disposable vapes and turn them into something new.

Read More

What is Duty of Care?

February 9, 2023

February 9, 2023

If you produce, transfer, or dispose of waste, you’re responsible for ensuring that its stored and treated safely. This is all part of your ‘Duty of Care’. But what exactly does this mean and how can you ensure you’re complying?

Read More

Your festival waste management checklist

February 7, 2023

February 7, 2023

Planning a festival? Here's our festival waste management checklist to make sure your waste is covered before your big event.

Read More

Why you should be recycling used pallets

February 2, 2023

February 2, 2023

There are over 30 million pallets in circulation. They’re a common site in many businesses and warehouses but do you know what you should be doing with them once you’ve finished using them? Your first thought might be to throw them in with your general waste, but pallets can be recycled and used again and again.

Read More

How to recycle engine or machine oil

January 30, 2023

January 30, 2023

Due to their qualities having the potential to cause harm to the environment, oil waste is considered hazardous. Therefore, it must be stored and disposed of correctly. However, there is still a route for your used engine or machine oil to be recycled.

Read More

How we turned waste wood into a new product

January 27, 2023

January 27, 2023

Your waste collection isn’t the end of your waste wood’s journey. By working with our network of approved suppliers, we’ve been able to turn waste wood into a brand-new product that can work as a more sustainable option to fossil fuels.

Read More

Is food waste recyclable?

January 24, 2023

January 24, 2023

It’s estimated that around 9.5 million tonnes of food waste are created each year in the UK. But is all this food waste recyclable and what happens to it if it’s recycled?

Read More

Engineering waste: What is it and how to dispose of it?

January 18, 2023

January 18, 2023

Waste from engineering can be potentially hazardous so it’s important the waste is disposed of correctly. Here’s our guide to engineering waste and how you can ensure your site is disposing of it as safely as possible.

Read More

What happens at a Waste Transfer Station?

January 16, 2023

January 16, 2023

Waste Transfer Stations are a vital step on the journey of waste management. In this guide, we explain what they are, what happens there, and how they are different to Material Recovery Facilities (MRF).

Read More

New Year’s Resolution to recycle more? Here’s how!

January 6, 2023

January 6, 2023

Looking to become more sustainable in 2023? One of the easiest ways to do this is by recycling more. Here’s our tips to help you recycle more.

Read More

What are the benefits of glass recycling?

December 22, 2022

December 22, 2022

Most glass is 100% recyclable and can be endlessly reused. But which types of glass can be recycled and what are the benefits of recycling it?

Read More

Reducing waste this Christmas

December 13, 2022

December 13, 2022

It’s estimated that household waste increases by 30% during the holiday period. Here’s our top tips for how you can reduce waste this Christmas.

Read More

How can you reduce your waste collections?

December 9, 2022

December 9, 2022

At a time where every penny matters, you may be looking to cut down on the number of waste collections you have to save your business money. Here’s our guide on how you can reduce the number of waste collections your business needs.

Read More

Reducing your restaurant waste costs

December 6, 2022

December 6, 2022

Restaurants in the UK throw away £682 million worth of food every year which is costing restaurants 97p per meal that they serve. But how do you reduce your waste costs and what other benefits might this have?

Read More

How can you improve your winter event waste management?

November 30, 2022

November 30, 2022

Winter events can generate a lot of waste and it can be difficult to manage and dispose of it properly. Here are some of our top tips to implement a cost-efficient and sustainable waste management strategy.

Read More

Scrap metal: How can you recycle it and maximise income?

November 24, 2022

November 24, 2022

Nearly all metals can be recycled into new products. Therefore, recycling your scrap metal can be great for the environment and your pocket.

Read More

Flame UK wins award at East Midlands Chamber Awards

November 23, 2022

November 23, 2022

Flame UK win big at the Nottinghamshire Business Awards 2022, hosted by the East Midlands Chamber of Commerce.

Read More

How to recycle your oil waste

November 21, 2022

November 21, 2022

Oil waste is one of the biggest pollutants in the world. Therefore, the safe storage and disposal of it is imperative. It also means that there are heavy regulations surrounding oil waste removal. But what is oil waste and how can you ensure you meet regulations when storing and disposing of it?

Read More

Why do you need a licenced waste carrier?

November 15, 2022

November 15, 2022

When you’re producing a lot of waste, it might be easy to pick the first waste carrier you come across. However, they may not be authorised to handle your waste and could be disposing it in ways that are damaging the environment. Therefore, it’s important to check that the waste carrier you’re choosing has a valid waste carrier licence.

Read More

PAT Testing: The ultimate guide

November 9, 2022

November 9, 2022

Portable Appliance Testing (commonly known as PAT testing) is often a confusing subject for many business owners but in reality its relatively simple.

Read More

How to recycle the different types of pallets

November 8, 2022

November 8, 2022

Pallets are used daily to help store and transport a variety of items. Here’s our guide to the different types of pallets and how they can be recycled.

Read More

What is WEEE waste and how can you recycle it?

November 1, 2022

November 1, 2022

Every year, an estimated two million tonnes of waste electrical goods are discarded by households and companies in the UK. To make sure that all this waste is disposed of correctly, there are legislations in place. But what are these regulations and what do they mean for you?

Read More

Easy changes to reduce your business waste costs

October 28, 2022

October 28, 2022

Your business’ waste might be at the bottom of your priority list, but it could be costing you more than it should. The UK generated over 222 million tonnes of waste in 2018 and disposing of this waste could become costly. Here’s our top tips to help you reduce your business’ waste costs.

Read More

How to avoid flooding this autumn

October 26, 2022

October 26, 2022

Autumn and winter bring rainy weather which can cause excess debris to build up in the drains and tanks on your site premises. Find out how to prevent flooding by keeping on top of cleaning and maintenance.

Read More

Green Halloween

October 26, 2022

October 26, 2022

Did you know that over 2000 tonnes of plastic are generated by Halloween costumes? read our tips on how to reduce plastic waste this Halloween.

Read More

How to dispose of asbestos correctly

October 24, 2022

October 24, 2022

Asbestos can become incredibly dangerous if it's not disposed of correctly. But what should you do if you find asbestos and how is it treated?

Read More

The benefits of recycling your dry mixed waste

October 20, 2022

October 20, 2022

Dry mixed waste often gets put in the general waste bin and sent to landfill, when it could be recycled. But what are the benefits of recycling it?

Read More

How to avoid being charged for heavy bins

October 14, 2022

October 14, 2022

Heavy bins aren’t always a bad thing. It’s a sign that you’re using your bin to its full capacity and making the most of what you’re paying for. However, they can cause a safety concern for the people collecting your waste, leaving you with a missed collection, health and safety hazards on your site and an extra charge for heavy bins.

Read More

What is an EWC Code and why do I need it?

October 12, 2022

October 12, 2022

The EWC Code is used to classify the many different types of waste companies can produce. But with 650 different codes, across 20 chapters, it can be tricky to navigate. Here’s our handy guide to help you break down the EWC code and figure out which code is best for your waste.

Read More

The Negative Effects of Landfill

October 7, 2022

October 7, 2022

On average the UK produces 26 million tonnes of waste and a whopping 55% of it ends up in landfill. But what are the alternative waste disposal options?

Read More

Paint Disposal Guide

October 4, 2022

October 4, 2022

You might have just repainted the office or had a revamp of the kitchen, leaving you with used or nearly empty paint cans and no idea on how to properly dispose of them. Paint can be tricky to dispose of and, if not done carefully, could have damaging effects on you or the environment.

Read More

Lifecycle of a pallet

September 29, 2022

September 29, 2022

Over 30 million pallets were in circulation in 2021 in the UK, with that number rising to four billion in Europe. While they’re great for delivering and storing materials, they can be tricky to manage due to their heavy and bulky nature. Therefore, our pallet collection and recycling service may be the best option for your business. Have you ever wondered what happens to your pallets once they’ve been collected by us?

Read More

Are you using the right sized bin?

September 27, 2022

September 27, 2022

There is a big demand for waste containers that suit specific needs. Multiple bins and containers have been created to help solve the issue of storing and moving waste in an efficient way, but is your bin right for you?

Read More

Reducing the Cost of School Waste

September 22, 2022

September 22, 2022

Schools in England throw away the equivalent weight of 185 double-decker buses of waste every school day. How can this be managed effectively?

Read More

Skip Hire Guide

September 20, 2022

September 20, 2022

With so many options to choose from, it can be difficult to figure out which skip works best for you. Here’s our handy guide to skips to help you figure out the best skip for your needs.

Read More

RWM LetsRecycleLive 2022

September 15, 2022

September 15, 2022

The Flame UK marketing team took a trip to the NEC in Birmingham to attend day one of the RWM LetsRecycleLive 2022 show. The exhibition was a great insight into the future of waste management and a chance for the team to see equipment and trucks live in their intended environment.

Read More

Sports Event Waste

September 12, 2022

September 12, 2022

The 2021 Tour of Britain saw almost 1.5 million spectators watching the race in person, with this year’s event expecting a similar turnout. Events with footfall like this have the possibility to generate a lot of waste, and it’s important that it’s managed properly. If not, there could be damage to the environment or hefty fines for event organisers.

Read More

Barton Town FC

September 9, 2022

September 9, 2022

Barton Town Football Club are taking steps to be more considerate of the environment, the first of those steps is to have designated recycling bins placed around the Easy Buy Stadium.

Read More

Hazardous Waste

September 8, 2022

September 8, 2022

Hazardous waste can come in many forms, and, if it's not disposed of correctly, it can be incredibly dangerous to the environment and humans.

Read More

Waste Equipment Guide

September 5, 2022

September 5, 2022

It’s essential for your business to manage the waste it produces properly and efficiently. Here’s our handy guide to help you choose which waste management equipment is best for your business.

Read More

Carbon Neutral Business

August 31, 2022

August 31, 2022

One of the biggest factors playing into the climate crisis is the impact of global warming. That’s why we’ve taken steps to become carbon neutral and are excited at the possibility of offering customers the option to offset the carbon emissions from their waste collections in the near future.

Read More

Why a Baler is Best for your Business

August 25, 2022

August 25, 2022

A waste baler is a unique piece of equipment designed to compact waste into bales in order to store waste more effectively. This can help you to save space and reduce the number of waste collections your business needs.

Read More

Confidential Waste

August 22, 2022

August 22, 2022

Identity theft and fraud is becoming more and more common across the UK. One of the biggest causes of this is the failure to properly dispose of confidential waste produced by businesses. Organisations are putting themselves in danger if they fail to carefully destroy their confidential documents.

Read More

Managing Care Home Waste

August 17, 2022

August 17, 2022

Managing different waste streams in a care home setting can be tricky. we hep you understand some tips for managing waste effectively.

Read More

Retail Business Waste

July 5, 2022

July 5, 2022

Retail businesses, whatever their size or whatever they sell, whether online or in a shop, face a unique challenge when dealing with their waste. If you have a retail business, the various waste streams generated mean you may have to think smarter to make sure your waste is managed effectively.

Read More

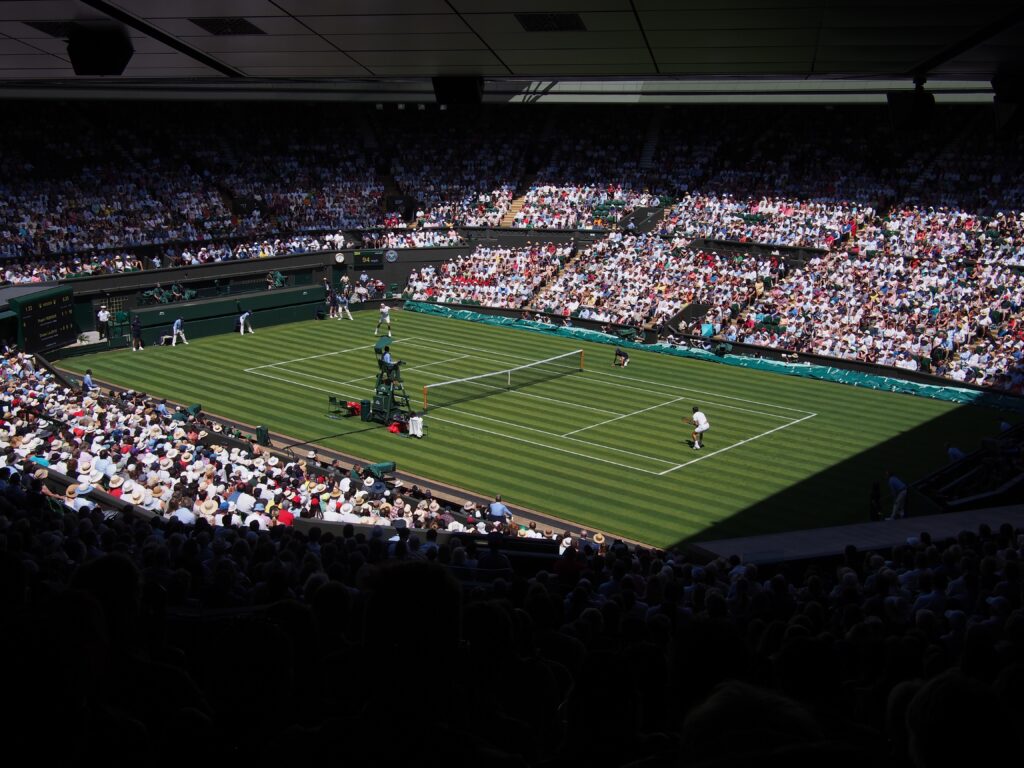

Hospitality waste – what can we learn from Wimbledon?

June 30, 2022

June 30, 2022

Hospitality venues generate a lot of waste - what can we learn from the efforts Wimbledon is making to ensure it's venue and events are sustainable?

Read More

Single Use Plastics

June 21, 2022

June 21, 2022

Only half of single use plastic bottles are recycled - with many finding their way into the sea.

Read More

Plastic-free packaging – could plants be the answer

June 16, 2022

June 16, 2022

Single use drinks bottles, coffee cups and packaging are not being recycled as much as they should be. We look at some alternatives to plastic that are more easily recycled and use more sustainable products to manufacture.

Read More

Event Waste

May 31, 2022

May 31, 2022

If you are organising an event, whether that be a multi-day music festival; a carnival; concert; corporate day or sports event such as a running race, you’ll need to consider what happens to the waste. Having hundreds or thousands of people at an event or festival creates a surprising amount of waste. As an organiser, you need to make sure that you have it covered.

Read More

2022 Las Vegas WasteExpo Q&A

May 23, 2022

May 23, 2022

We caught up with our Flame UK Account Managers after they attended the 2022 Waste Expo to find out what they got up to and talk about the new and exciting innovations in the waste industry.

Read More

Are Electric Vehicle (EV) Batteries Really a Green Option?

May 17, 2022

May 17, 2022

Electric vehicles are greener but lithium batteries from EVs are very difficult and costly to recycle. Why is this and what progress is being made to develop a recycling process?

Read More

What does “Zero to Landfill” Really Mean?

May 9, 2022

May 9, 2022

Many waste carriers state that they send zero to landfill. Sounds great, right? But what does “zero to landfill” actually mean? We all know that landfill sites are not a good way to dispose of waste. Not only are they unsightly, noisy, and damage biodiversity, but can cause all sorts of environmental and health issues. Decomposing waste can cause methane gas to be produced, not to mention other chemicals leaking into the ground and watercourses. So there should be no excuses for sending waste to landfill that could be processed in a better way.

Read More

The Impact of Fast Fashion

April 20, 2022

April 20, 2022

Fast Fashion is an environmental disaster and can harm the environment and contribute to poor working practices. We look at sustainable fashion and what happens to waste textiles.

Read More

The Rising Costs of Business Waste Disposal

April 20, 2022

April 20, 2022

Factors such as rises in fuel prices, the end of the red diesel concession for the waste sector and landfill tax means that the costs of disposing of your business waste has crept up yet again.

We look at a number of factors in this price increase and what you can do to reduce the cost of waste disposal in your business.

Read More

WEEE Disposal and Recycling Targets

April 13, 2022

April 13, 2022

Household Waste Electrical and Electronic Equipment is the fastest growing waste stream in the UK. news recycling targets have been set to ensure that WEEE is dealt with properly. We look at what WEEE is and how it is disposed.

Read More

Quick Guide – Extended Producer Responsibility guidance published by DEFRA

March 30, 2022

March 30, 2022

This week, DEFRA published the results from the consultation on Extended Producer Responsibility – placing the responsibility for disposal costs of packaging onto the producers of that packaging.

There are many complex areas to the consultation result – we’ve summarised the key points below.

Read More

Construction Waste Guide

March 23, 2022

March 23, 2022

Construction waste has become a big problem in recent years, from the effect on the environment to the rising cost, proper construction waste management and disposal has never been more important.

Read More

Waste not , want not. How much food waste do we really generate?

March 1, 2022

March 1, 2022

We are still discarding enormous amounts of food, which often end up in landfill. What are we throwing away, and why should be making sure it doesn't go into landfill ?

Read More

Seven simple steps to reduce your business waste costs.

February 23, 2022

February 23, 2022

How much does your company spend on waste disposal? Business waste management is often an afterthought – we pay for collection of bins or containers, but rarely think about how the costs of business waste disposal could be reduced – often significantly – with a few simple changes.

Read More

Plastic Packaging Tax – are you ready?

February 14, 2022

February 14, 2022

Plastic Packaging Tax is coming into effect on 1st April. We answer questions about what this means for businesses that import or manufacture and how to make sure your business is ready.

Read More

Illegal fly-tipping: whose responsibility?

February 1, 2022

February 1, 2022

We’ve seen in the news this week that the government have announced new plans to tackle waste crime by proposing stricter checks and mandatory waste tracking. We have a look at the impact of illegal waste dumping, what it means to you and how to make sure your waste doesn’t get dumped illegally.

Read More

New year, new strategy? Why you should regularly review your business waste strategy.

January 19, 2022

January 19, 2022

Do you know what and how much your business throws away? Regularly reviewing your waste has direct implications on your business, your staff and your time. Here are some reasons why you should check your waste strategy today.

Read More

What has happened to the wood waste market?

July 27, 2021

July 27, 2021

Like many of the challenges faced for businesses over the past 18 months or so not everything has a single route cause, some could say Brexit, or COVID or even a tanker blocking a major trade route, these issues singularly have a major impact on global business but when they happen in unison it can create the perfect storm for a very stormy business environment.

Read More

A new resource for collecting and recycling pallets

April 26, 2021

April 26, 2021

We all know how widely used wooden pallets are these days, with the surge in online deliveries and retailers moving to larger distribution-based business models the wooden pallet is here to stay. The reuse of pallets is now commonplace, deliveries arrive into many businesses on pallets and the same number of pallets are returned for reuse this works really well in large businesses and distribution networks.

Read More

The future of skips

April 7, 2021

April 7, 2021

The trusted waste skip has been in use in mass since the ’60s and little has changed. They still look the same, still collected by the same types of vehicles, and still made from the same heavy steel.

Read More

Rising waste costs

February 26, 2021

February 26, 2021

2020 has been a very difficult year for many businesses, the waste industry has seen its share of difficulties too. As we get ready for a busy 2021 we are wanted to share some key points in the industry that have had impacts on the industry.

Read More

Can you help prevent flooding at your business?

February 18, 2021

February 18, 2021

Flooding is affecting more businesses every year, we have seen people lose their livelihoods on TV and in news articles as water levels rise and take everything in its wake as they burst their banks.

Read More

How to remove airborne viruses in your office

May 28, 2020

May 28, 2020

How healthy and hygienic is the air quality in your office? You can be reassured its the best it can possibly be with Citron Clear, an environmentally friendly solution designed to fit into any workplace. Using the latest UV technology it removes bad smells, eliminates airborne and surface bacteria and kills 99.5% of all airborne viruses.

Read More

Is your city the worst fly tipped in the UK?

May 6, 2020

May 6, 2020

Fly tipping is the illegal dumping of waste onto land, including being tipped on a site with no license to accept waste, instead of using authorised methods such as kerbside collection.

Read More

Waste disposal costs are rising – here’s why

January 16, 2020

January 16, 2020

The waste industry in the UK is having a difficult time, global markets have driven recycling revenues down, tax increases and levies threaten disposal routes, and the uncertainty of the market post-Brexit has all added to an already struggling market. It has been well publicised how the world’s doors have closed to UK exported waste

Read More

What you need to know about mop contracts

October 19, 2019

October 19, 2019

A MOP (Meter Operator) agreement is a contract that’s separate from other electricity agreements where you will be invoiced directly from your Meter Operator.

Read More

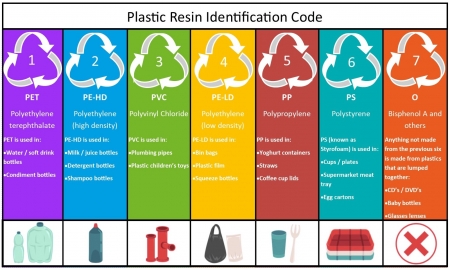

Can you identify your plastics?

August 27, 2019

August 27, 2019

You may have already noticed the little triangles on your plastic packages, but do you know what they mean? Most people think it just means that the item is recyclable, but this is not the case. Inside those triangles are numbers

Read More

Do my controlled drugs need denaturing?

August 15, 2019

August 15, 2019

Unwanted or out of date controlled drugs need to be denatured. This must be before they are destroyed so that they cannot be recovered, reused or retrieved.

Read More